What is Medicare Supplement insurance?

Medicare Supplement insurance is sold by private companies. Sometimes called "Medigap," it can help you pay for out-of-pocket health care expenses that Medicare doesn't cover, such as deductibles, coinsurance, copayments or outpatient services.

Benefits of Medicare Supplement insurance

What are the four parts of Medicare and what do they offer?

Medicare Parts A and B are known as "Original Medicare." Parts C and D are voluntary coverages.

Medicare Part A

Hospital insurance

Medicare Part B

Medicare insurance

Medicare Part C

Medicare Advantage

Medicare Part D

Prescription drug coverage

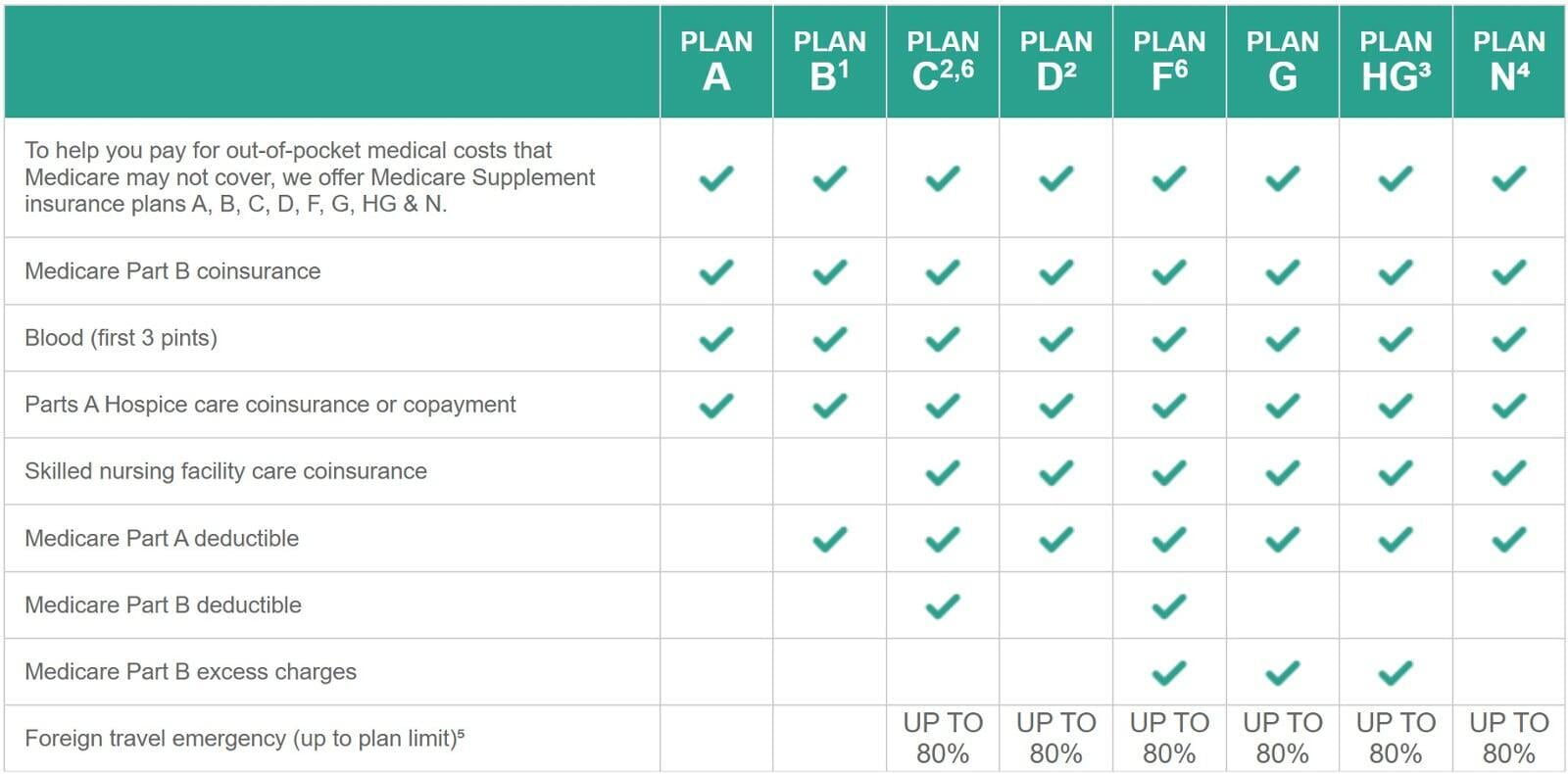

Compare the features of Medicare Supplement insurance plans*

To help you pay for out-of-pocket medical costs that Medicare may not cover, we offer Medicare Supplement insurance plans A, F, G, HG and N. We also offer Plan B in Pennsylvania and Plans C and D in New Jersey. Our knowledgeable agents/producers can help explain how each plan works and answer your questions related to Medicare or Medicare Supplement insurance.

*These are standard Medicare Supplement insurance benefits.

1 Plans subject to state availability. Plan B is offered only in the state of PA.

2 Plans subject to state availability. Plan C and Plan D are only offered in the state of NJ.

3 Plans F and G also have a high deductible option which require first paying a calendar year deductible (amount adjusts annually). Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year. High deductible plan G does not cover the Medicare Part B deductible. However, high deductible plans F and G count your payment of the Medicare Part B deductible toward meeting the plan deductible.

4 Plan N requires a copayment of up to $20 for doctor’s visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission.

5 Covers foreign travel emergency care if it begins during the first 60 days of your trip and if Medicare doesn't otherwise cover the care. Includes a lifetime maximum benefit of $50,000 with a $250 calendar year deductible.

6 Plans C and F are only available to persons who are first eligible for Medicare before 1/1/2020.

How do I know if I'm eligible for Medicare Supplement insurance?

To buy a Medicare Supplement plan, you must be enrolled in Original Medicare Parts A & B. Legal residents must live in the U.S. for at least five years in a row, including the five years before applying for Medicare. You must live in the state where the policy is offered, and be age 65 or over or, in some states, under age 65 with a qualifying disability.

Call (916) 253-8151 or visit request a free quote to learn what Medicare plan you may be eligible for.

Why Us?

Simplified application process

Personalized approach

We take a personalized approach to help protect the individuals and families we serve. As you enter and navigate retirement, we will be by your side every step of the way, helping to protect your financial security.

Service you can trust

Our agents/producers travel to your home or business. Our goal is to provide excellent service to every policyholder and make your life easier when it comes to your claims.