What is life insurance and why do I need it?

Life insurance offers a way to provide for your loved ones. It pays them a sum of money that may help protect them from the financial impact of your passing. Life insurance can be an important aspect of retirement planning—helping bring peace of mind and financial security for your family.

How can life insurance help protect my family?

What type of life insurance policy suits me the best?

Finding a policy that’s right for your needs is easier when you know the types of life insurance that are available and what they're designed to do. Answer some important questions when deciding which type and what amount of life insurance is right for you:

- What do you want the insurance to cover?

- What amount of coverage do you need?

- How long will you need the coverage?

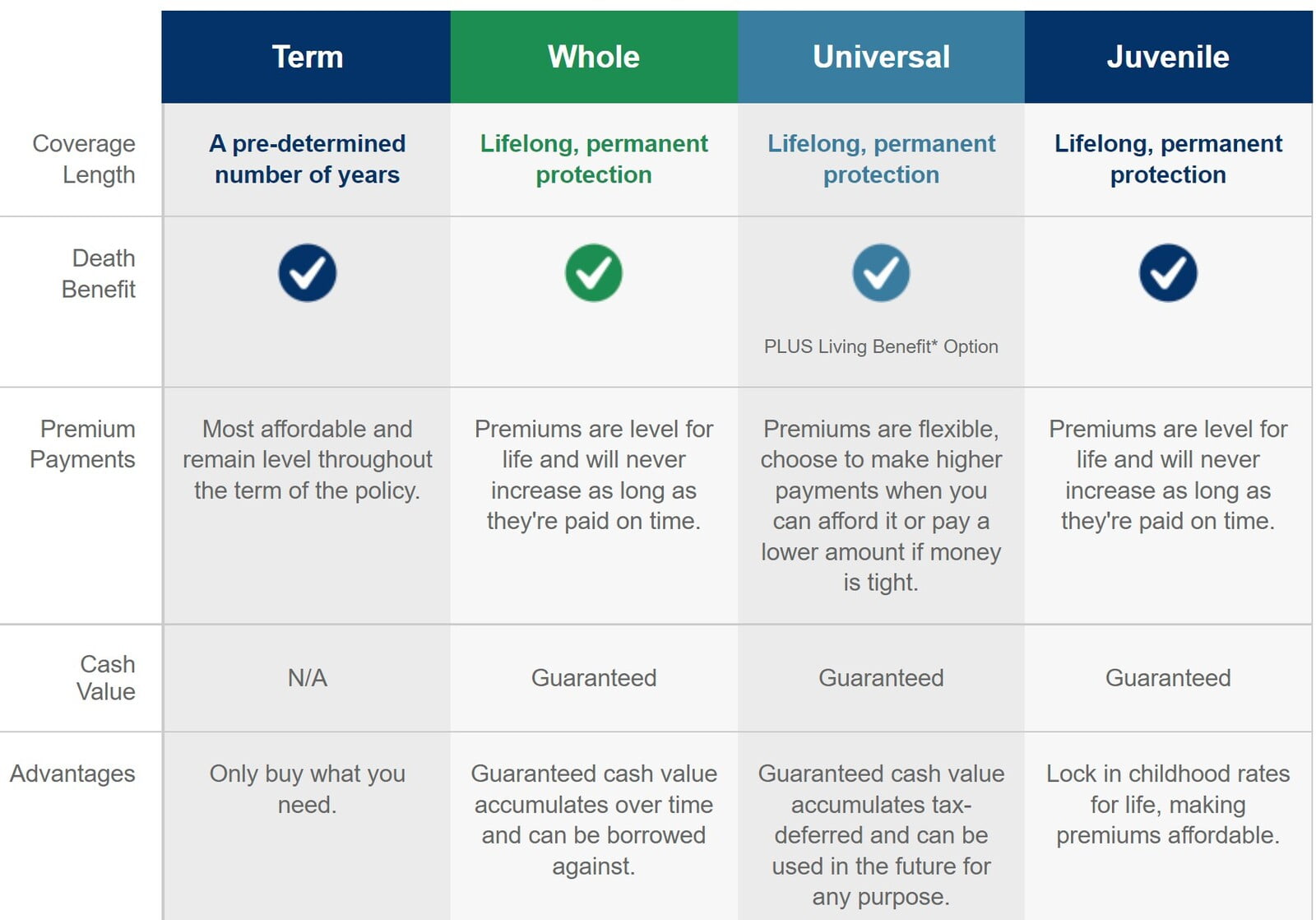

Compare types of life insurance policies

Bankers Life offers several temporary and permanent insurance options that have one sure thing in common: Each pays a death benefit when the covered person passes away. The money can be used by heirs to replace income, pay off debts, or leave a legacy. But the plans can differ in terms of coverage length, premium flexibility, cash value accumulation and distribution.

How do I know if I’m eligible for life insurance?

Step one in obtaining life insurance is completing an application. Our underwriters will review your medical history to determine if your application is acceptable, and to identify your risk classification. You may need a medical exam. In general, the younger and healthier you are, the less the cost of life insurance.

How is the cost of life insurance determined?

Some life insurance policies go through underwriting, which is the process of assessing risks faced by the insured. Premiums may vary based on the type of life insurance plan chosen (i.e. term, whole life, universal life). Your premium amount will be determined in part by the amount of insurance coverage you request, your age, gender and risk classification. Additional risks that can impact cost include tobacco use, health/medical history, and risky hobbies/jobs.

Why Us?

Simplified application process

Personalized approach

We take a personalized approach to help protect the individuals and families we serve. We focus on helping you improve upon your financial security, particularly as you enter and navigate retirement.

Service you can trust

Our agents/producers travel to your home or business. Our goal is to provide excellent service to every policyholder and make your life easier when it comes to your claims.